Retirement Planning – 401k: A Comprehensive Guide

Planning for retirement is important for financial security and peace of mind. One of the best ways to save for retirement in the U.S. is through a 401k plan. This guide covers the basics, how to set up an account, and choosing the right provider.

What is a 401k?

A 401(k) plan is a retirement savings account offered by employers. Employees can contribute a portion of their paycheck. Many employers also match a percentage of these contributions. The money grows tax-deferred until retirement, meaning taxes are paid only when funds are withdrawn.

Types of 401k Plans

There are two main types of 401(k) plans:

- Traditional 401(k): Contributions are made before taxes, reducing taxable income. Taxes are paid when withdrawals are made in retirement.

- Roth 401(k): Contributions are made after taxes. However, withdrawals in retirement, including earnings, are tax-free if certain conditions are met.

How to Set Up a 401k Plan

If your employer offers a 401(k), follow these steps:

- Check Eligibility: Some employers have waiting periods before you can enroll.

- Choose Your Contribution Amount: Decide how much of your salary to save. Experts suggest saving 10-15% of your income.

- Take Advantage of Employer Match: If your employer offers matching, contribute at least enough to get the full match. This is free money!

- Select Your Investments: Choose from mutual funds, index funds, or target-date funds. Consider your risk tolerance and retirement timeline.

- Monitor and Adjust: Review your contributions and investments regularly to stay on track.

Major 401k Providers

Many financial companies offer 401(k) plans. Some popular providers include:

- Vanguard – Known for low-cost index funds.

- Fidelity – Offers a wide range of investments and great customer service.

- Charles Schwab – Provides competitive fees and planning tools.

- T. Rowe Price – Specializes in actively managed mutual funds.

- Empower Retirement – Offers strong digital tools and services.

Key Benefits of a 401k Plan

Tax Advantages

One major benefit of a 401(k) is tax savings. Traditional 401(k) contributions reduce taxable income and grow tax-deferred. Taxes are paid when funds are withdrawn in retirement. Roth 401(k) contributions are taxed upfront, but withdrawals, including earnings, are tax-free in retirement if conditions are met.

Employer Matching

Many employers match contributions, helping you grow your savings faster. For example, if your employer matches up to 5% of your salary and you contribute 5%, they add the same amount. This is extra money that boosts your retirement fund.

Automatic Payroll Deductions

A 401(k) makes saving easy with automatic payroll deductions. Your chosen amount is taken from your paycheck before you receive it. This helps you save consistently and removes the temptation to spend the money elsewhere.

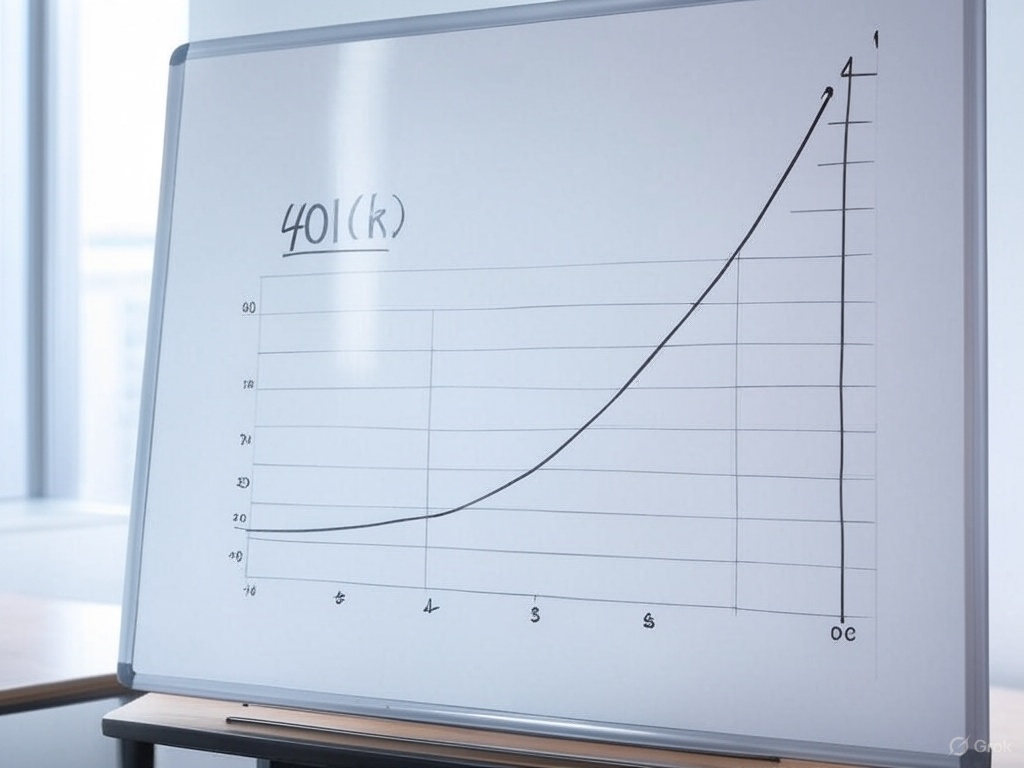

Compound Growth

A 401(k) benefits from compound growth. Your money grows through investment returns, and those returns generate more earnings over time. The earlier you start, the more you benefit from compounding.

Protection from Creditors

In most cases, 401(k) savings are protected from creditors under federal law. If you face financial trouble, your retirement savings remain safe from debt collectors.

Loan and Hardship Withdrawal Options

Although it’s best to leave funds untouched, many plans offer loan and hardship withdrawal options for emergencies. However, early withdrawals may come with tax penalties and fees.

Portability

If you change jobs, 401(k) savings can be rolled over into a new employer’s plan or an IRA. This keeps your retirement savings intact and growing.

Conclusion

A 401(k) is a powerful tool for retirement planning. It offers tax benefits, employer contributions, and long-term growth. Whether you’re starting your career or nearing retirement, maximizing your 401(k) can help ensure financial security. Start today and build a strong future!

FAQs

1. What is the 401(k) contribution limit for 2024?

For 2024, the limit is $23,000 for those under 50 and $30,500 for those 50 and older (including catch-up contributions).

2. Can I withdraw from a 401(k) before retirement?

Yes, but early withdrawals before age 59½ may face a 10% penalty and income taxes unless you qualify for exceptions.

3. What happens if I change jobs?

You can roll over your 401(k) into a new employer’s plan or an IRA to keep your savings growing.

Making informed choices and saving consistently will help secure your future. Start planning today!

Managing money can feel overwhelming, especially for small business owners and individuals juggling expenses, savings, and investments. But with the right personal wealth management, you can take control of your finances and build long-term security. Already savvy with investing, you can learn about diversified portfolio here. You can learn more about 401k here.