How Inflation-Proof Is Your Portfolio? Tactics to Guard Your Portfolio from Inflation Risk

Inflation has become one of the hottest financial topics of recent years. Whether you’re a seasoned investor or just starting out, the rising cost of living eats into savings and can quietly erode the value of your portfolio. The question is: how inflation-proof are your investments?

The good news is, there are proven strategies to help protect your wealth from inflation risk. By understanding the impact inflation has on different assets, you can make smarter decisions and keep your portfolio resilient, even in uncertain times.

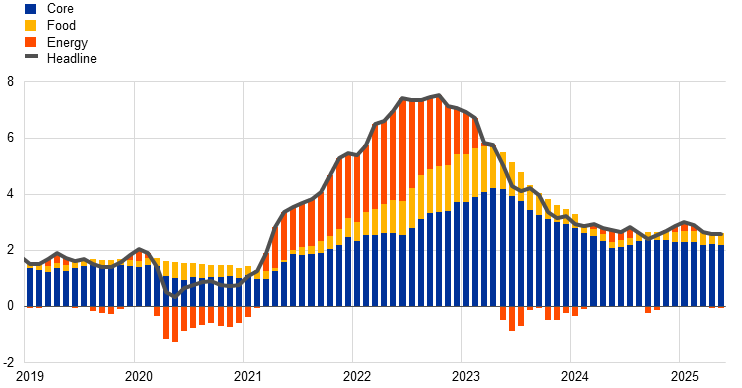

Notes: The OECD aggregate excludes Türkiye and is calculated using OECD CPI annual weights. The latest observations are for May 2025.

Understanding Inflation and Its Impact on Investments

Inflation is the gradual rise in prices over time, reducing the purchasing power of money. For investors, this means that the same dollar buys fewer goods and services in the future. Left unchecked, inflation can significantly cut into investment returns.

Stocks, bonds, and cash all respond differently to inflation. Some assets lose value quickly, while others hold steady or even thrive in an inflationary environment. That’s why inflation-proofing your portfolio is essential.

Why Inflation Risk Matters for Your Portfolio

When inflation rises, fixed-income investments like traditional bonds and savings accounts often underperform. Meanwhile, assets like commodities, real estate, and certain types of stocks may provide a buffer. Ignoring inflation risk can mean losing out on long-term growth and stability.

If you want a deeper dive into proactive measures, see How to Protect Your Wealth from Inflation in 2025: 8 Smart Strategies.

Diversification: The First Step Toward an Inflation-Proof Portfolio

Diversification remains the cornerstone of any strong investment strategy. By spreading your assets across various classes—stocks, bonds, commodities, and real estate—you reduce the chances of inflation wiping out your returns.

Remember: no single asset class consistently beats inflation. A mix of investments is your best defense.

Real Assets: A Natural Hedge Against Inflation

Real estate and commodities, such as gold and oil, tend to rise with inflation. These “real assets” have intrinsic value and often perform well when the purchasing power of money falls. Adding them to your portfolio can provide an inflation-proof shield.

Stocks That Weather Inflation Better

Not all stocks suffer when inflation spikes. Companies with strong pricing power—like consumer staples and utilities—can pass higher costs onto customers without losing demand. Dividend-paying stocks are also worth considering, as they provide steady income that may keep pace with inflation.

Inflation-Proofing with Treasury Inflation-Protected Securities (TIPS)

TIPS are government bonds designed specifically to protect investors from inflation. Their principal value adjusts with inflation, making them a direct hedge. While they may not offer the highest returns, they add valuable stability to an inflation-proof portfolio.

Alternative Investments to Consider

Private equity, infrastructure, and even certain hedge funds can offer protection during inflationary times. While these are not for every investor, they may diversify your holdings and guard against inflation risk.

Keep an Eye on Cash Holdings

Holding too much cash is one of the fastest ways to lose to inflation. Although cash provides liquidity and safety, its value declines in an inflationary environment. Instead, balance your cash reserves with investments that can outpace rising prices.

Building a Long-Term, Inflation-Proof Strategy

The key to guarding your portfolio from inflation isn’t about reacting to headlines. It’s about long-term planning. By combining diversification, real assets, inflation-linked securities, and carefully selected stocks, you can build a portfolio designed to withstand inflation risk year after year.

Final Thoughts: Is Your Portfolio Really Inflation-Proof?

Inflation may be inevitable, but losing purchasing power doesn’t have to be. By taking a proactive approach—diversifying investments, adding inflation-friendly assets, and staying disciplined—you can protect your wealth and give your portfolio the resilience it needs to thrive.

External Resources

2025 Inflation Outlook: High and Could Be Higher — AXA Investment Managers discusses forecasts for inflation in 2025 and how different regions may be affected. AXA IM Core

Global Economic Outlook, January 2025 — Deloitte insight into economic trends, inflation expectations, and how inflation may evolve globally, especially in services and wage growth. Deloitte

OECD Economic Outlook, Volume 2025 Issue 1 — The OECD full report which includes policy implications, investment, inflation, and how different economies are preparing. OECD

Fixed Income Outlook 3Q 2025 — From Goldman Sachs, focusing on fixed income, yields, inflation expectations and related risks. Helpful where you cover inflation’s impact on bonds and fixed income investments. Goldman Sachs Asset Management

Economic Bulletin Issue 5, 2025 – European Central Bank — ECB’s summary of recent inflation trends in the euro area, policy decisions, and inflation outlook. Useful for when you talk about inflation targets and central bank responses. European Central Bank