How to Read Financial Statements as a Non-Finance Founder

If the words balance sheet or cash flow statement make your eyes glaze over, you’re not alone. Many founders build great products and teams without a finance background. But at some point, every owner has to understand Financial Statements well enough to make smart decisions.

The good news? You don’t need to be an accountant. You just need to know what to look for, what questions to ask, and how Financial Statements connect to the day-to-day reality of your business.

This guide breaks it all down in plain English.

Why Financial Statements Matter More Than You Think

Financial Statements aren’t just for tax time or investors. They tell the story of your business in numbers.

When you understand them, you can:

- Spot problems early

- Make confident pricing and hiring decisions

- Improve cash flow

- Avoid nasty surprises

Think of Financial Statements as your business dashboard. You don’t need to know how the engine works—just what the warning lights mean.

The Three Core Financial Statements You Need to Know

Every small business relies on three main Financial Statements. Each answers a different question.

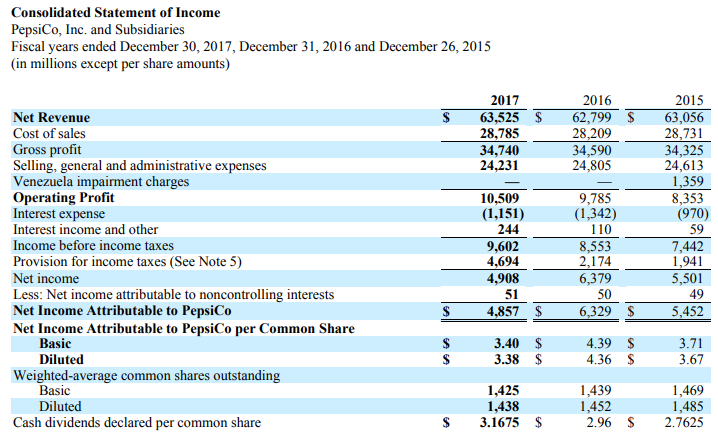

Financial Statements Explained: The Income Statement (Profit & Loss)

What it shows:

How much money you made, how much you spent, and whether you earned a profit over a period of time.

Key sections to focus on:

- Revenue (sales)

- Cost of goods sold

- Gross profit

- Operating expenses

- Net profit

Founder tip:

Profit looks great on paper, but it doesn’t mean cash is in the bank. Many profitable businesses still struggle to pay bills.

Financial Statements Explained: The Balance Sheet

What it shows:

What your business owns, owes, and what’s left over at a specific point in time.

The simple formula:

Assets = Liabilities + Equity

What to watch:

- Cash balance

- Loans and credit cards

- Accounts receivable and payable

Founder tip:

If liabilities grow faster than assets, it’s a warning sign, even if sales are strong.

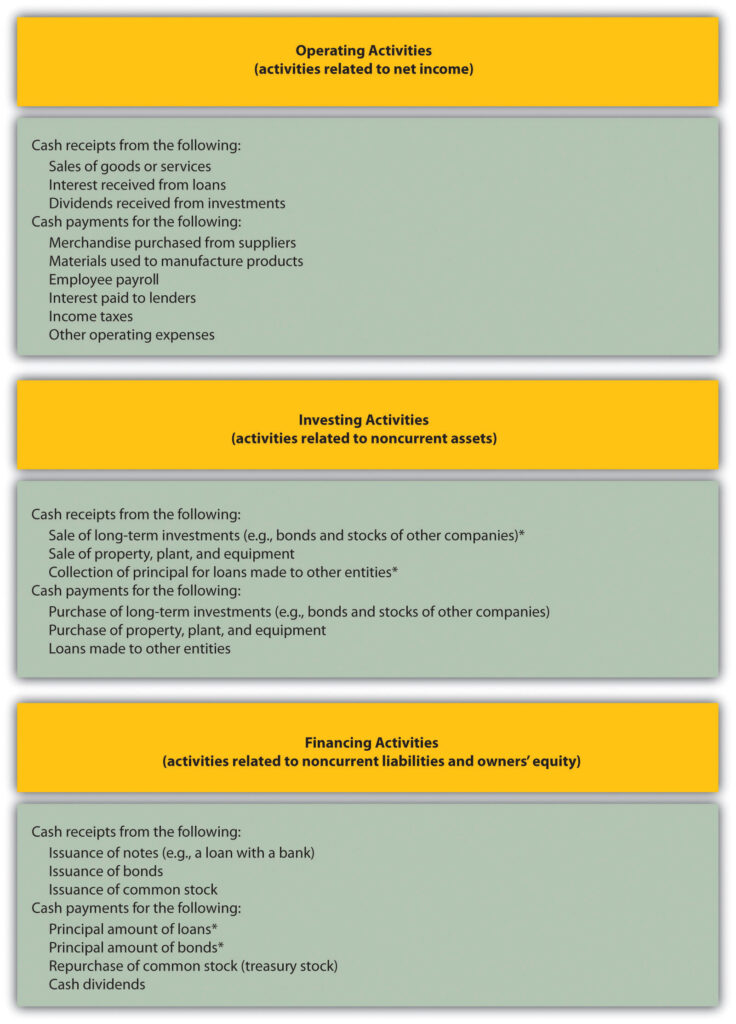

Financial Statements Explained: The Cash Flow Statement

What it shows:

Where your cash actually came from and where it went.

This statement is critical because it explains why you can be profitable and still feel broke.

Three sections:

- Operating activities (day-to-day business)

- Investing activities (equipment, assets)

- Financing activities (loans, repayments)

Founder tip:

Cash flow keeps the lights on. Never ignore this statement.

How Financial Statements Work Together

The biggest mistake founders make is looking at Financial Statements in isolation.

- The income statement shows profit

- The cash flow statement shows reality

- The balance sheet shows stability

When read together, Financial Statements explain why your business feels healthy or stressed.

Financial Statements and Budgeting: The Missing Link

Your Financial Statements should feed directly into your budget.

If you’re budgeting without reviewing past performance, you’re guessing. Historical financial data gives you a grounded starting point for planning and managing cash.

For a deeper dive, explore this internal guide on budgeting and cash flow management:

👉 Budgeting and Cash Flow Management Strategies for Small Business Owners and Individuals

Common Financial Statement Mistakes Non-Finance Founders Make

Even smart founders fall into these traps:

- Confusing profit with cash

- Ignoring the balance sheet

- Only reviewing numbers once a year

- Not asking “why” behind changes

Financial Statements are most powerful when reviewed monthly, not annually.

How Often Should You Review Financial Statements?

At a minimum:

- Monthly: Income statement and cash flow statement

- Quarterly: Balance sheet review

- Annually: Big-picture trends and planning

Regular reviews help you catch issues before they turn into crises.

Financial Statements vs Financial Forecasting

Understanding current performance is only half the job. The next step is looking ahead.

Budgeting tells you where you plan to go. Forecasting shows where you’re likely headed based on real data.

This post explains the difference clearly:

👉 Budgeting vs. Financial Forecasting: What’s the Difference?

Simple Questions to Ask When Reviewing Financial Statements

You don’t need complex formulas. Start with these:

- Is revenue growing consistently?

- Are expenses rising faster than sales?

- Do we have enough cash for the next 90 days?

- Are debts manageable?

If you can answer these confidently, you’re already ahead of many founders.

Final Thoughts: Financial Statements Are a Skill You Can Learn

You don’t need to love numbers to understand Financial Statements. You just need a clear framework and a habit of reviewing them regularly.

Once you get comfortable, Financial Statements stop being intimidating and start becoming one of your strongest decision-making tools.