Understanding Burn Rate: A Guide for Small Business Owners

If you’ve ever checked your bank balance and thought, “Where did all the money go?”, then you’re already thinking about Burn Rate, whether you realise it or not.

Burn Rate is one of those finance terms that sounds like it belongs in a VC pitch deck, but in reality, it’s just as important for everyday small business owners. It tells you how fast your business is spending cash and, more importantly, how long you can keep operating before you need more money.

This guide breaks Burn Rate down in plain English, shows you how to calculate it, and explains how to use it to make better decisions without spreadsheets taking over your life.

What Is Burn Rate (And Why It Matters)

Burn Rate is the amount of cash your business spends over a set period, usually per month.

In simple terms:

- It’s how quickly cash is “burning” to keep the business running.

- It shows how sustainable your current setup really is.

- It acts as an early warning system when things start drifting off course.

For small businesses, Burn Rate isn’t about impressing investors, it’s about staying in control of cash flow.

Gross Burn Rate vs Net Burn Rate

Not all Burn Rate numbers tell the same story. There are two types you should know:

Gross Burn Rate

This is your total monthly expenses, before revenue.

Example:

- Rent, salaries, software, marketing, insurance

- Total monthly costs: $18,000

👉 Gross Burn Rate = $18,000

Net Burn Rate

This factors in revenue.

Example:

- Monthly expenses: $18,000

- Monthly revenue: $13,000

👉 Net Burn Rate = $5,000

Net Burn Rate is usually the more useful number because it shows how much cash you’re actually losing each month.

How to Calculate Burn Rate (Without Overthinking It)

You don’t need complex tools to get started.

Simple Net Burn Rate formula:

Monthly Expenses – Monthly Revenue = Net Burn Rate

If the result is:

- Positive → You’re burning cash

- Zero → You’ve broken even

- Negative → You’re cash-flow positive

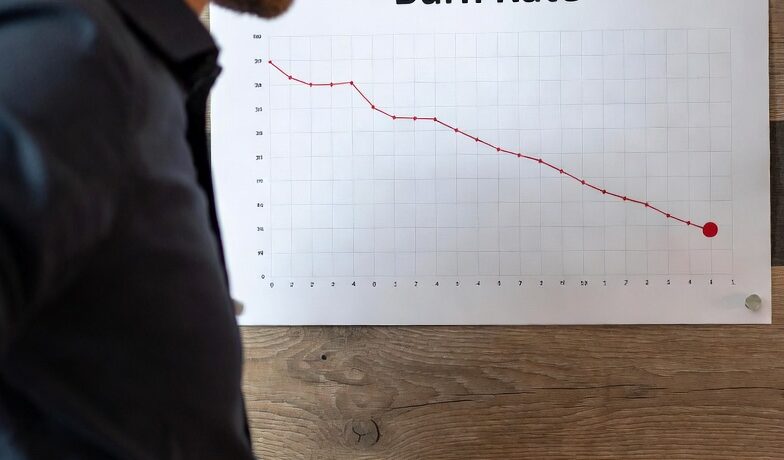

Track this monthly, not once a year. Burn Rate changes faster than most founders expect.

Burn Rate and Cash Runway: The Connection

Burn Rate becomes powerful when paired with cash runway.

Cash Runway = Cash in Bank ÷ Net Burn Rate

Example:

- Cash available: $60,000

- Net Burn Rate: $5,000/month

👉 Runway = 12 months

This tells you how long your business can survive if nothing changes. That clarity alone often leads to better decisions.

Common Burn Rate Mistakes Small Businesses Make

Ignoring Burn Rate Until It’s Too Late

Many founders only look at cash when it’s nearly gone. Burn Rate helps you spot trouble early.

Confusing Profit with Cash

You can be “profitable” on paper and still burn cash due to timing, debt repayments, or tax.

Treating Burn Rate as Fixed

Burn Rate isn’t permanent. It changes with pricing, hiring, subscriptions, and growth choices.

Burn Rate vs Financial Forecasting

Burn Rate tells you what’s happening now. Forecasting tells you what might happen next.

If you want to go deeper, this internal guide explains how the two work together:

👉 Financial Forecasting 101 for New Entrepreneurs

When Burn Rate and forecasting are aligned, founders stop reacting and start planning.

How to Reduce Burn Rate (Without Killing Growth)

Reducing Burn Rate doesn’t always mean cutting everything back.

Review Fixed Costs First

Subscriptions, tools, and services quietly add up. If it’s not essential, pause it.

Tie Spending to Revenue

Marketing, hiring, and expansion should scale with income — not hope.

Improve Cash Timing

Faster invoicing, upfront payments, and shorter payment terms can reduce Burn Rate without cutting costs.

Focus on High-Impact Expenses

Some costs create growth. Others just create comfort. Learn the difference.

When a Higher Burn Rate Makes Sense

Burn Rate isn’t automatically bad.

A higher Burn Rate can be justified when:

- You’re investing in growth with clear returns

- Revenue growth is predictable

- You understand your runway and risks

The danger isn’t spending, it’s spending blindly.

Burn Rate Benchmarks (Context Matters)

There’s no “perfect” Burn Rate.

A bootstrapped service business will look very different from a fast-growing tech startup. What matters most is whether your Burn Rate matches your strategy and cash position.

For a deeper breakdown of how Burn Rate is viewed across business types, here is a solid explanation:

👉 Understanding Burn Rate

Why Burn Rate Awareness Changes Everything

Once you truly understand your Burn Rate:

- Decisions become calmer

- Growth feels intentional

- Financial stress drops

- Planning becomes clearer

Burn Rate isn’t just a number. It’s a visibility tool that helps founders stay in control even when things get messy.

Final Thoughts

Every small business has a Burn Rate. The successful ones track it, understand it, and adjust it early.

If you know how fast cash is leaving your business and how long it will last, you’re already ahead of most founders. And once Burn Rate becomes part of your regular financial rhythm, surprises become a lot rarer and a lot less painful.